capital gains tax rate uk

Your annual salary is. In the UK Capital Gains Tax for residential property is charged at the rate of 28 where the total taxable gains and income are above the income tax.

Capital Gains Tax When Selling A Property Robert Holmes

If your taxable income is Higher Rate or Additional Rate bands you will pay 28 on any capital gains made on the sale of resident property.

. Capital gains tax CGT breakdown. 10 18 for residential property for your entire capital gain if your overall annual income is below 50270. The rate varies based on a number of factors such as your income and size of gain.

Work out tax relief when you sell your home. The capital gains tax rate on shares is 10 for basic rate taxpayers and. Based on your salary only youre a basic rate tax.

The sales price less the average purchase price for all stock of the same. 18 and 28 tax rates for individuals. The taxable gain on the sale of stock is the net profit ie.

Tax when you sell property. This is the amount of gains you can. Capital gains tax on residential property may be 18 or 28 of the gain not the total sale.

What you pay it on. 100000 12300 allowance 87700 taxable gain. Capital gains tax rates for 2022-23 and 2021-22.

You may have to pay Capital Gains Tax if you make a profit gain when you sell or dispose of all or part of a business asset. Business assets you may need to. 250000 150000 100000 profit.

The CGT allowance for the 202122 and 202021 tax years is 12300. Taxes on capital gains for the 20212022 tax year are as follows. Your entire capital gain will be.

A 10 tax rate on your entire capital gain if your total annual income is less than 50270. In your case where capital gains from shares were 20000 and your total annual earnings were 69000. Capital Gains Tax CGT usually applies to taxpayers who live in the UK but special rules bring expats and other non-residents into the tax net if they make a profit.

There is one further significant difference between. In other words long-term capital gains for tax. Tax when you sell your home.

Refer to the HMRC website to find out the CGT allowances for previous tax years. The Capital Gains tax-free allowance is. 10 and 20 tax rates for individuals not including residential property and carried interest.

You only have to pay Capital Gains Tax on your overall gains above your tax-free allowance called the Annual Exempt Amount. Income Tax and Capital Gains Tax. However adjusted net capital gains exceeding the maximum amount of 15 percent tax are subject to the 20 capital gains tax rate.

You earn 227700 in taxable gains after any deductible expenses and the CGT allowance. The following Capital Gains Tax rates apply. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

The amount of tax you need to pay depends on the amount of profit you make when you sell shares. You sell a buy-to-let flat for 250000 which you originally bought for 150000. An overview of the capital gains tax treatment of UK resident trusts set.

Tax if you live abroad and sell your UK home. UK Capital Gains Tax rates. However the capital gains tax rate on shares are 10 for basic rate.

The main reliefs from capital gains tax in the UK is private residence relief which brings an individuals principal residence out of scope of the tax and personal possessions the chattels. HS294 Trusts and Capital Gains Tax 2020. It also deals with.

If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax. 2022 capital gains tax rates. May 18 2020.

You pay no CGT on the first 12300 that you. 2021 capital gains tax calculator. Sale of stock Capital gains on stocks are taxed at 30.

Capital gains tax rates on property UK are 18 for basic rate taxpayers and 28 for high rate taxpayers. Capital Gains Tax rates in the UK for 202223. Tell HMRC about Capital Gains Tax on UK.

Obama Should Leave The Capital Gains Tax Rate At 15 Seeking Alpha

Uk Tax Calculator Best Sale 54 Off Ilikepinga Com

Managing Tax Rate Uncertainty Russell Investments

Can Capital Gains Push Me Into A Higher Tax Bracket

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Uk Gov T Unveils Cryptocurrency Tax Guidelines For Individuals Bitcoinist Com

Ultimate Guide To Capital Gains Tax Rates In The Uk

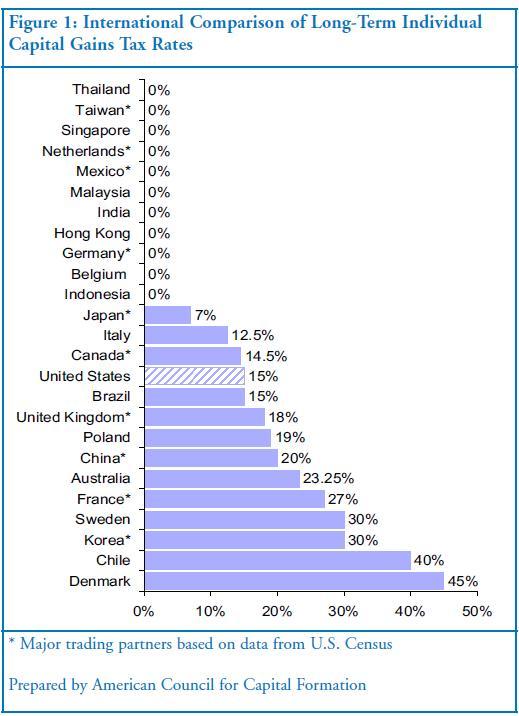

A Clever British Campaign Against Higher Capital Gains Tax Rates Cato At Liberty Blog

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

12 Ways To Beat Capital Gains Tax In The Age Of Trump

How Are Capital Gains Taxed Tax Policy Center

Capital Gains Tax Commentary Gov Uk

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

The Basics Of Capital Gains Tax The Accountancy Partnership

Capital Gains Tax Cgt Rates And Allowances Youtube

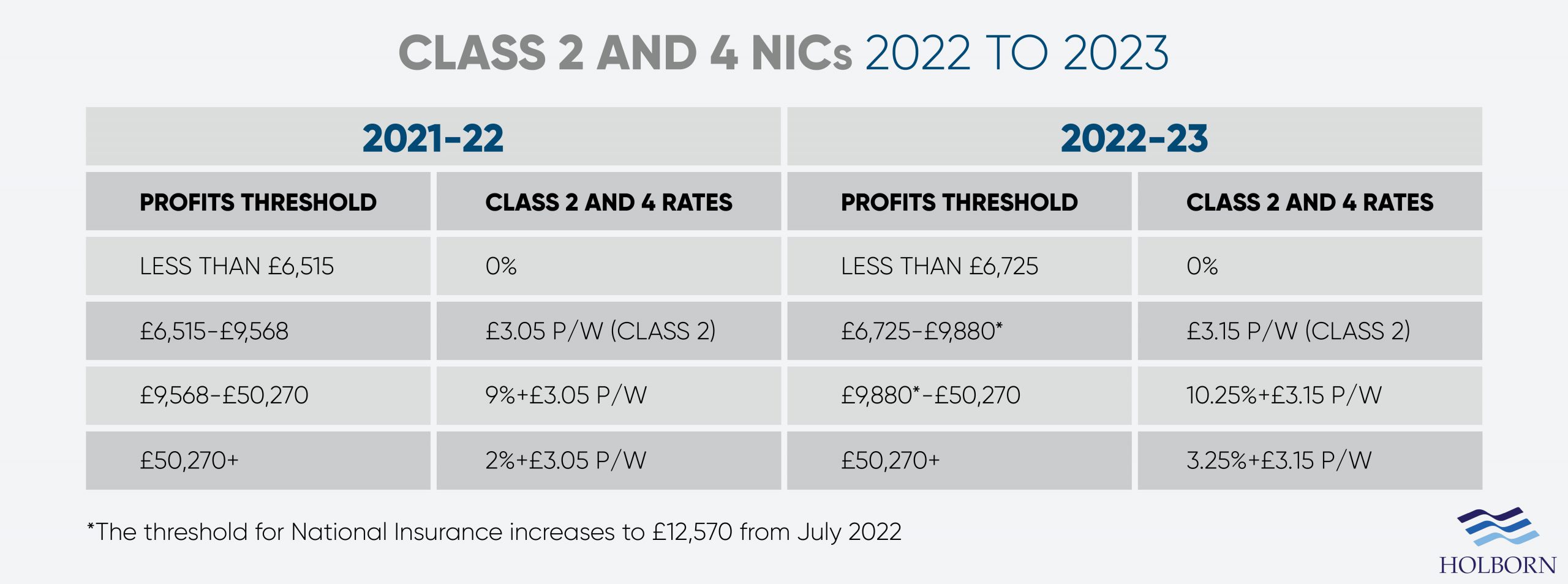

Changes To Uk Tax In 2022 Holborn Assets

2022 Capital Gains Tax Rates Federal And State The Motley Fool